Reduced roth ira contribution calculator

Contributions are made with after-tax dollars. Open A Roth IRA Today.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

. Reduced Roth IRA Contribution Limit Calculator. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Reviews Trusted by Over 45000000.

There are no income limits. So assuming youre not ready to retire next year you desire growth and also focused investments for your Roth IRA. We Go Further Today To Help You Retire Tomorrow.

You can adjust that contribution. Annual IRA Contribution Limit. This figure is the amount you reduce from your maximum contribution.

Sheena is 47 years old and single so her maximum contribution was 5000 which she multiplies by 0667. Your 2019 Roth IRA contribution limit will calculate. Subtract from the amount in 1.

9 rows Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3. We Go Further Today To Help You Retire Tomorrow. For 2022 the maximum annual IRA.

For 2021 your Roth IRA contribution limit is reduced phased out in the following situations. So to calculate your reduced Roth IRA contribution limit you first calculate the percentage of the way you are through the 10000 phaseout range and then multiply that. To put it simply you.

Eligible individuals age 50 or older within a particular tax year can make an. Open A Roth IRA Today. It is mainly intended for use by US.

Roth IRA contribution limit calculator is devised to help you estimate the amount of contribution possible in your case for the tax year 2020 and 2019. Adjusted Gross Income AGI 125000. You can contribute to a Roth IRA if your Adjusted Gross Income is.

The amount you will contribute to your Roth IRA each year. Roth IRA Reduced Contribution Calculator. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

This calculator assumes that you make your contribution at the beginning of each year. Start with your modified AGI. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

For comparison purposes Roth. For 2020 Roth IRA contributions are reduced if income is between 124000 and 139000 and contributions are not available if income exceeds 139000. The calculator will estimate the monthly payout from your Roth IRA in retirement.

Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022.

Compare 2022s Best Gold IRAs from Top Providers. Roth Ira Reduced Contribution Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and. Ad Learn About 2021 IRA Contribution Limits.

Your filing status is married filing jointly or qualifying widower and your modified AGI is at. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. Where it comes from.

Ad Use Our Calculator To Help Determine How Much You Are Eligible To Contribute To An IRA. Ad Learn About 2021 IRA Contribution Limits. Less than 140000 single filer Less than 208000 joint filer Less than.

It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. This limit applies across all IRA accounts.

Assuming youre not about to retire following year you want development as well as concentrated investments for your Roth IRA. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Roth Ira Calculator Roth Ira Contribution

Historical Roth Ira Contribution Limits Since The Beginning

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Roth Ira Calculator How Much Could My Roth Ira Be Worth

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

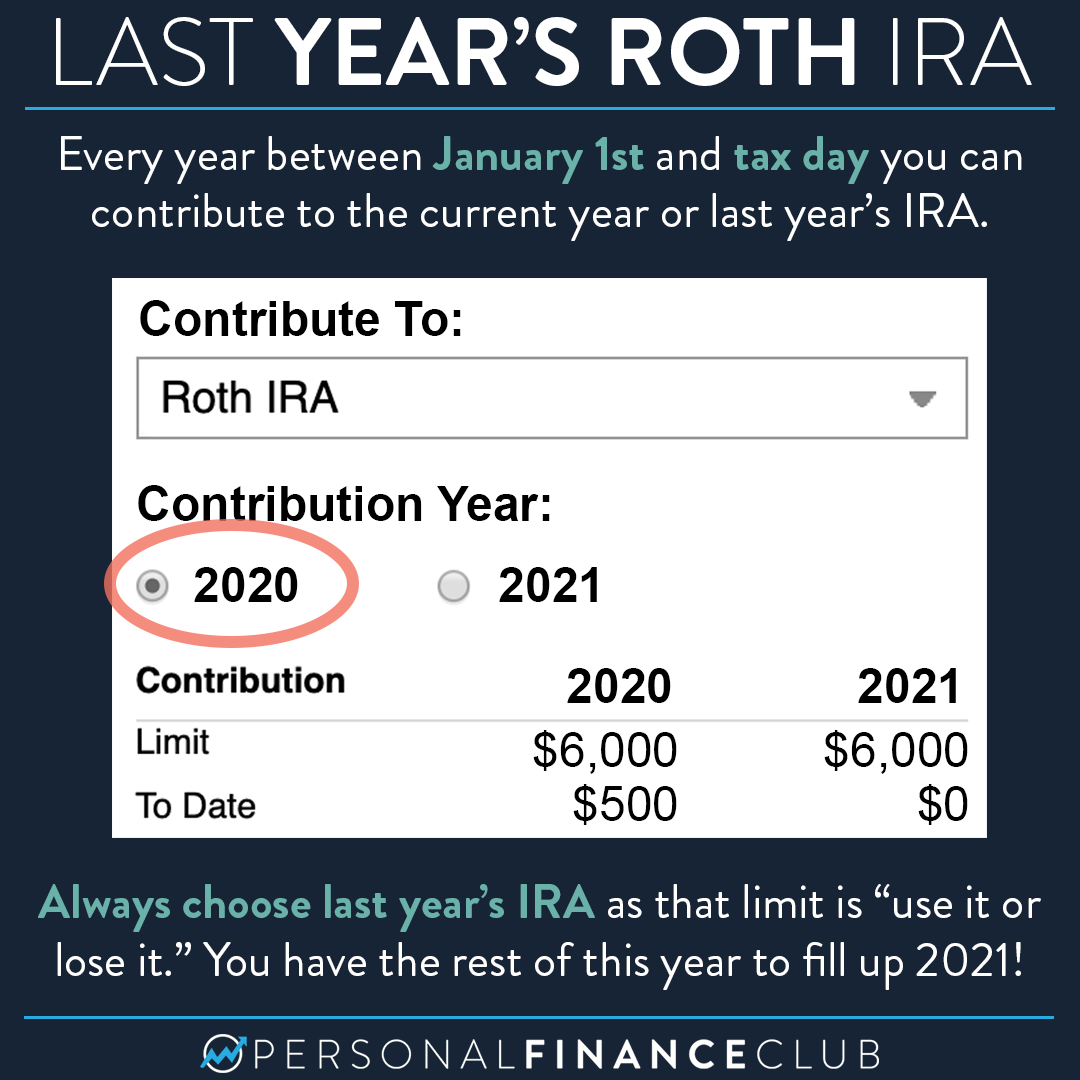

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

What Is The Best Roth Ira Calculator District Capital Management

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

Contributing To Your Ira Start Early Know Your Limits Fidelity

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account